Negotiation Scripts for Vendor Commitments: Get Better Terms Without Legal Teams

Most startups overpay for IT services by accepting standard vendor agreements. But with the right negotiation strategies, you can save 10–30% on cloud and SaaS costs – without needing a legal team. Here’s how:

- Audit your usage: Identify unused licenses (most companies only use 47% of their SaaS seats) and set commitments to 50–60% of projected needs.

- Leverage timing: Negotiate near vendor fiscal year-ends (e.g., AWS: Dec 31, Microsoft: Jun 30) to unlock bigger discounts.

- Request better terms: Cap price hikes at 3–5%, waive egress fees, and secure flexible reduction rights for unused capacity.

- Use scripts: Tailored negotiation scripts can help you lock in discounts (e.g., 20–30% for large commitments), extend payment terms, and improve SLAs.

Even without legal expertise, you can advocate for better pricing, predictable costs, and flexibility. Start with preparation, data, and timing to turn negotiations into a win for your startup.

B2B Purchasing Negotiation Five Strategies to Reduce Vendor Prices

sbb-itb-f9e5962

Preparation: Understand Your Usage, Requirements, and Vendor Leverage

When entering negotiations, data is your best ally. Replace guesswork with hard numbers by gathering detailed metrics on roles, departments, and license usage. For example, instead of claiming, "we need 500 seats", you can show evidence like, "only 235 seats were active in the last 90 days". Once you’ve confirmed your usage data, shift your focus to analyzing cloud costs and identifying gaps in your current commitments.

Analyze Cloud Costs and Commitment Levels

To get a clear picture of your expenses, build a "spend cube" by combining data from accounts payable, procurement, and the general ledger. Add insights from shadow IT sources like SSO logs, expense reports, and network monitoring. This approach uncovers where your money is going and when your commitments are set to expire. A surprising finding? 67% of employees at Fortune 1000 companies use unapproved SaaS applications. Consolidating these into a single enterprise agreement can immediately give you better pricing leverage.

Before making new commitments, address inefficiencies. Deactivate licenses that have been unused for 90 days – keeping in mind that most organizations only use 47% of their purchased SaaS licenses. To avoid overcommitting, set your usage commitments at 50–60% of projected needs, as unused capacity rarely qualifies for rollover credits.

Research Vendor Pricing Models and Industry Benchmarks

Cloud service discounts are often tied to the size of your spending. For example, an AWS customer spending $1 million annually might see discounts of just 5–6%, but a $50 million commitment could unlock savings of 18–20%. For AWS’s Enterprise Discount Program (EDP), smaller commitments typically yield 6–9% discounts, while larger deals can reach double-digit savings. Similarly, Azure customers spending $5 million or more can negotiate 20–30% off list prices. Google Cloud offers Committed Use Discounts (CUDs) that save 37% for 1-year commitments and 55% for 3-year commitments on general VMs.

Timing your negotiations with a vendor’s fiscal year-end can also work in your favor. For instance, Microsoft’s fiscal year ends on June 30, Salesforce’s on January 31, and AWS and Google’s on December 31. Sales teams aiming to hit quarterly targets are often more willing to approve substantial discounts. To avoid rushed decisions, start your audit and strategy planning 6–12 months before a major renewal. Armed with pricing benchmarks, you’ll be better prepared to negotiate terms that support both growth and compliance.

Define Required Terms for Scalability and Compliance

To ensure flexibility and protect against vendor lock-in, focus on negotiating non-price terms. For example, include annual price caps (3–5% or tied to CPI) and volume-based tiered pricing to control costs. Scalability can be supported with ramp-up structures, such as committing $1 million in Year 1, $2 million in Year 2, and $3 million in Year 3. Additionally, secure the right to reduce commitments by 10–15% if necessary.

Other critical terms include data residency requirements, limited audit rights, and strong SLAs with service credits ranging from 10–50%. Ensure data portability and negotiate waivers for egress fees, which can be a significant expense. For instance, in May 2025, the University of California successfully negotiated an egress fee waiver with Google Cloud, removing a financial hurdle for their multi-cloud analytics strategy. These provisions not only prevent vendor lock-in but also give you the flexibility to switch providers if future terms become unfavorable.

Negotiation Scripts for Pricing and Contract Terms

Once you’ve gathered your usage data and industry benchmarks, it’s time to put that information to work. These negotiation scripts are designed to turn your research into meaningful cost savings and better contract terms. The key is a structured approach: state your commitment, cite industry standards, and ask for specific outcomes. This method not only demonstrates your preparation but also fosters a collaborative tone with vendors.

Scripts for Pricing and Volume Discounts

When it comes to discounts, volume is your most powerful bargaining chip. It has a greater impact than simply extending contract terms. To negotiate effectively, tie your discount requests to industry benchmarks. For significant enterprise spending – think seven figures or more – start by requesting a 20–25% discount off list prices.

The Benchmark Script:

"Based on our $X annual commitment, can we align on a Y% discount to match industry benchmarks for this volume?"

For instance, if you’re committing $5 million annually to Azure, it’s reasonable to request a 20–30% discount off list prices, which aligns with typical expectations for that level of spend.

The Competitive Pressure Script:

Leverage competing offers to your advantage:

"Azure/GCP offers $X in credits and a Y% discount for a similar scope – what can you offer to retain our business?"

As an example, AWS customers spending $50 million annually often secure an 18–20% discount through the Enterprise Discount Program.

The Layered Discount Script:

"We’re ready to commit to a 3-year term, but we need the discount to apply across all services and include a ‘Negotiated Savings’ layer on top of the standard committed use discounts."

This approach works particularly well with Google Cloud, where 3-year commitments on general VMs can cut costs by up to 55% compared to on-demand rates.

Now, let’s look at how to negotiate terms that ensure predictable pricing over the long term.

Scripts for Capping Price Increases and Multi-Year Discounts

SaaS pricing inflation is currently running at about 8.7%, significantly outpacing general market inflation. Without price caps, you could face steep renewal increases of 10–20%. Multi-year agreements can shield you from these hikes, provided you secure the right terms.

"Multi-year doesn’t get you a bigger discount. Multi-year gets you access to discounting at all."

– CJ Gustafson, CFO

The Price Protection Script:

"We’re open to a multi-year deal if you cap annual price increases at 3–5% and include usage forecasts."

Link price caps to the Consumer Price Index (CPI) or a fixed percentage for stability. While multi-year deals often provide just a 2–3% additional discount compared to one-year agreements, their real value lies in preventing future cost escalations.

The Ramp-Up Script:

"We’ll commit to a 3-year term with a ramp-up structure: $1 million in Year 1, $2 million in Year 2, and $3 million in Year 3, with locked-in rates for each tier."

This strategy aligns your spending with adoption rates, reducing the risk of overcommitting early on.

The Step-Down Script:

"Can we include automatic rate reductions that activate as our usage grows? For example, every additional 1,000 seats could lower our unit price by 2%."

This creates a win-win: the vendor benefits from predictable growth, and you enjoy better pricing as you scale.

With pricing stability addressed, let’s explore how to improve cash flow through extended payment terms.

Scripts for Extended Payment Terms

Most vendors default to Net 30 payment terms, but negotiating Net 60 or Net 90 terms can significantly improve your working capital. The key is crafting a deal that benefits both sides.

The Cash Flow Script:

"Can we move to Net 60 terms with an annual prepay for an additional 10% discount?"

This approach offers vendors financial certainty through prepayment while supporting your cash flow. Annual upfront payments often yield discounts of 10–20%, but ensure that extended terms don’t negate these savings.

The Consolidation Script:

"We’re willing to consolidate all our contract dates into a single annual invoice if you extend payment terms to Net 90 while maintaining our current discount level."

This simplifies vendor operations and helps you streamline budgeting.

The Fiscal Timing Script:

"We’re ready to sign this week to help you close your quarter, but we need Net 60 terms and a 5% cash flow discount to make it work."

Timing your negotiation to align with the vendor’s fiscal year-end (e.g., January 31 for Salesforce, June 30 for Microsoft, December 31 for AWS and Google) can increase their flexibility on payment terms.

"We are negotiating a 3-year term to lock in a 25% discount… however, to preserve cash flow, we are rejecting the vendor’s request for upfront multi-year payment and insisting on annual or semi-annual billing terms."

– Lejay

Scripts for SLAs, Support, and Contract Flexibility

Once you’ve secured favorable pricing, it’s time to focus on service levels and flexibility. These non-pricing terms – like uptime guarantees, support response times, exit rights, and scalability – directly impact how smoothly your operations run. They also determine whether you’re tied to rigid terms or have the ability to adjust as your business evolves.

Scripts for Uptime and Response SLAs

Let’s put uptime guarantees into perspective: a 99.5% uptime means about 3.6 hours of downtime each month, which adds up to 43 hours annually. That’s a lot of potential revenue down the drain. On the other hand, a 99.99% uptime commitment slashes downtime to just 4.4 minutes per month – much more manageable.

The Business Impact Script:

"Our retail operations lose $50,000 per hour of downtime. With a 99.5% guarantee, we risk 43 hours of lost sales annually. We need a 99.9% uptime commitment or a tiered credit structure that reflects our actual losses during outages."

The Tiered Credit Script:

"We require service credits on a sliding scale: 5% for 99.0% uptime, 10% for 98.0%, and 25% for anything below 95%. While standard vendor credits often max out at 10% of the monthly fee, we expect up to 25% for severe failures."

The Support Response Script:

"For our premium Enterprise Support, we need a 15-minute response time for P1 incidents and a dedicated Technical Account Manager."

"SaaS vendors commonly claim that their service level agreements are non-negotiable, but that is usually not true!"

– Nada Alnajafi, In-House Counsel

Scripts for Exit Rights and Data Portability

Vendor lock-in can be a nightmare, especially when it comes with hefty data egress fees or limited access to your own data after the contract ends. Fortunately, major providers like Google Cloud and AWS have started waiving egress fees for customers who migrate all workloads and terminate their agreements.

The Exit Fee Waiver Script:

"We require no-fee data export within 30 days of termination, provided in standard formats like CSV, JSON, or Parquet. Additionally, all egress charges should be waived if we migrate off your platform entirely."

The Termination for Convenience Script:

"We need the ability to terminate for convenience with 90 days’ notice, rather than being restricted to cases of material breach. This ensures we can adapt to changing business needs."

The Transition Support Script:

"Include 30–90 days of post-termination technical support to ensure a smooth migration process."

| Term | Standard Provision | Negotiated Provision |

|---|---|---|

| Exit/Egress Fees | Egress fees per GB | Waived for total platform migration/exit |

| Data Export Window | Access terminated immediately | 30–90 days post-termination access |

| Data Formats | Proprietary or restricted formats | Standard formats (CSV, JSON, SQL, Parquet) |

| Termination Rights | Only for material breach | For convenience with 30–90 days’ notice |

Scripts for Scalability and Reduction Rights

Your business needs can shift unexpectedly – sometimes faster, sometimes slower. Without flexibility, you might end up paying for capacity you don’t use. Negotiating reduction rights and scalability options can help prevent this.

The Reduction Rights Script:

"Allow us to reduce commitments by up to 20% annually without penalties, locking in only 50–60% of our projected spend."

The Rollover Script:

"Permit us to carry over up to 15% of unused committed spend into the next contract year or extend the term accordingly."

The Service Fungibility Script:

"Ensure our committed spend functions as a flexible pool, usable across any service or geographic region, rather than being tied to specific legacy products."

Take Airbnb’s experience during the COVID-19 pandemic as an example. Facing a usage slowdown, they renegotiated a 3-year extension on their $1.2 billion AWS commitment, avoiding penalties for unused capacity. Similarly, Snap Inc. restructured its AWS deal, transitioning from a 5-year, $1 billion agreement to a 6-year, $1.1 billion deal – lowering annual costs while gaining more flexibility.

"Avoid locking into long-term commitments that don’t align with your evolving needs."

– AWS Negotiation Guide

These scripts ensure you’re not just negotiating price but securing terms that protect your operations and give you room to adapt.

Handle Objections and Close the Deal

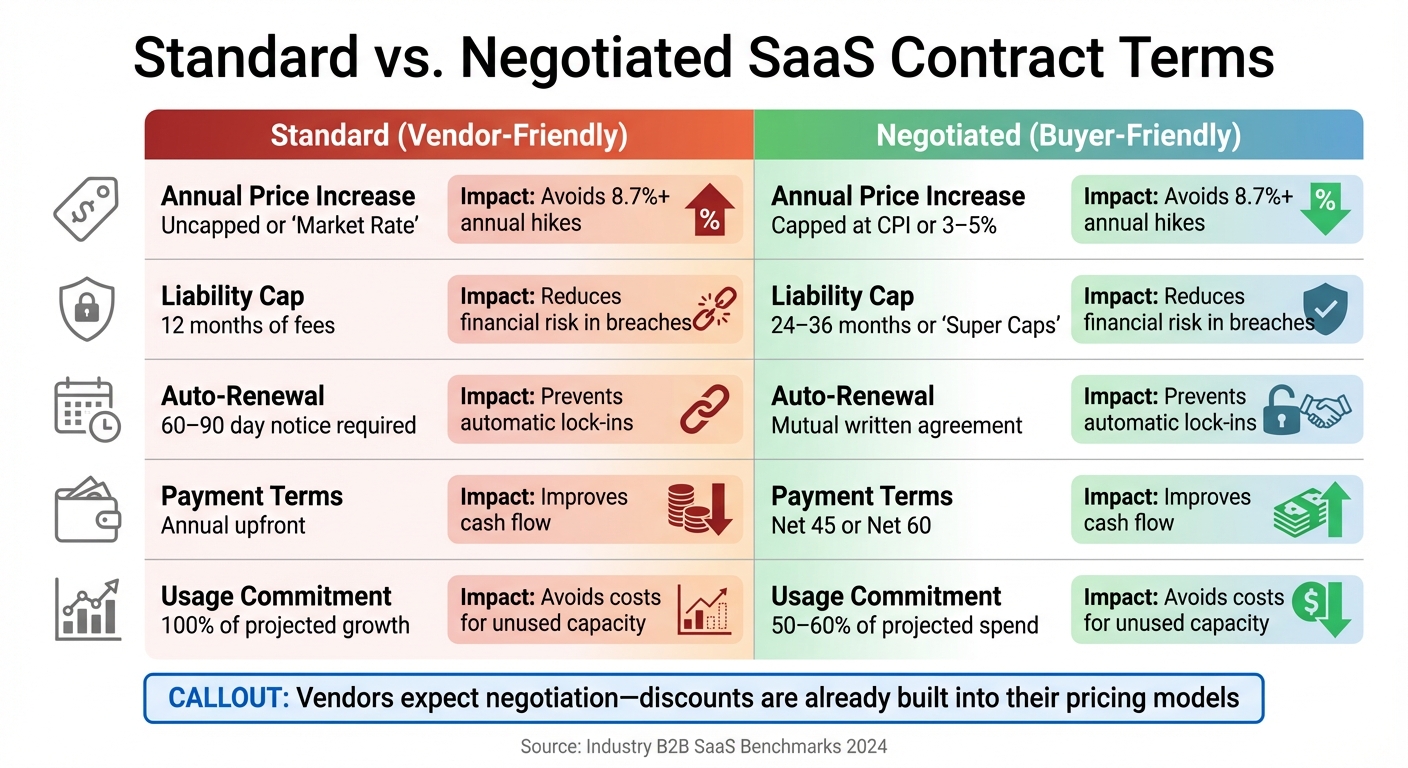

Standard vs Negotiated SaaS Contract Terms Comparison

You’ve laid the groundwork and delivered your pitch, but now the vendor resists. This is where negotiations often hit a wall – but it doesn’t have to be the end of the road. Knowing how to address objections effectively and using timing alongside solid data can steer the conversation toward a better deal.

Counter Common Vendor Objections

Vendor objections tend to follow predictable patterns. A "give-get" framework can help you respond strategically – never give ground without gaining something in return.

When they say: "We can’t offer that pricing."

You respond: "If you can match a 25% discount, we’re ready to commit to a 3-year term. Otherwise, we’ll explore other options."

When they say: "Our terms are standard and non-negotiable."

You respond: "Other contracts we’ve seen include price caps at 3% annually and termination for convenience clauses. Can we align on those terms, or should we consider other solutions?"

When they say: "You need to commit to 100% of your projected growth."

You respond: "We’re prepared to commit to 50–60% of projected spend to avoid paying for unused capacity. For a larger commitment, we’d need either a proportional discount or rollover rights for unused spend."

"Successful negotiation is not about getting to ‘yes’; it’s about mastering ‘no’ and understanding what the path to an agreement is."

– Christopher Voss, CEO and former FBI hostage negotiator

Avoid becoming another statistic of overpaying companies. The next step? Leverage timing and metrics to solidify your position.

Use Timing and Metrics as Leverage

Building on counterarguments, timing and data are your secret weapons. Vendors are often more flexible at the end of their fiscal year when sales teams are scrambling to hit quotas. For instance, Salesforce and Workday close their fiscal years on January 31, Microsoft on June 30, and AWS and ServiceNow on December 31. Negotiating in the final two weeks of these periods can unlock an extra 5–15% in discounts.

But timing alone isn’t enough. You need data to back your case. Audit your licenses using the 90-Day Rule (discussed earlier) to reduce your baseline unit count and prove you’re serious about optimizing spend.

Metrics like cost per deployment and cost per active user can demonstrate ROI. Let’s say you’re paying $50,000 annually for a tool, but only 47% of licenses are active – close to the industry average. This gives you leverage to argue for a 50% reduction in seats or a proportional discount.

Comparison Table: Standard vs. Negotiated Terms

To highlight the benefits of effective negotiation, here’s a quick comparison:

| Term | Standard (Vendor-Friendly) | Negotiated (Buyer-Friendly) | Savings/Impact |

|---|---|---|---|

| Annual Price Increase | Uncapped or "Market Rate" | Capped at CPI or 3–5% | Avoids 8.7%+ annual hikes |

| Liability Cap | 12 months of fees | 24–36 months or "Super Caps" | Reduces financial risk in breaches |

| Auto-Renewal | 60–90 day notice required | Mutual written agreement | Prevents automatic lock-ins |

| Payment Terms | Annual upfront | Net 45 or Net 60 | Improves cash flow |

| Usage Commitment | 100% of projected growth | 50–60% of projected spend | Avoids costs for unused capacity |

A great example of negotiation success is Snap Inc. In 2017, they restructured their AWS deal from a 5-year, $1 billion commitment to a 6-year, $1.1 billion agreement. This "blend and extend" strategy reduced their annual costs while increasing flexibility. Similarly, Airbnb extended their $1.2 billion AWS contract by three years during the pandemic to avoid penalties for unused capacity.

"Don’t be shy to negotiate with SaaS vendors."

– Dave Beckwith, VP of Global Procurement at 8×8

The reality? Vendors expect you to push back – and chances are, the discounts you’re aiming for are already baked into their pricing.

Case Studies: Metrics-Driven Results for SaaS and AI Startups

Track Savings and Operational Improvements

When it comes to measurable success, these examples highlight how negotiation scripts and strategic cost management can lead to impressive savings and operational gains. For startups aiming to scale, these results provide a clear blueprint for action.

Take CloudZero, for instance. In February 2023, the company identified $1.7 million in annualized savings by zeroing in on unit economics instead of just looking at total spend. Led by SVP of Engineering Bill Buckley, the team renegotiated their Snowflake contract – responsible for 63% of their total spend – saving $145,000 annually. On top of that, they streamlined their "Billing Ingest" feature, cutting data normalization efforts by threefold and saving an additional $1,098,000. The outcome? A 10% boost in gross margin and an incredible 24x return on their FinOps platform investment.

"88% ($1.498M) of these savings came from our engineers. Not from rightsizing or RI management but from… cost intelligence combined with our engineers’ understanding of the platform and its underlying code." – Bill Buckley, SVP of Engineering, CloudZero

Upstart tackled cloud costs from another angle. In 2023, Principal Engineer Chris Gray spearheaded a project that slashed annual cloud expenses by $20 million. The team addressed $700,000 in annualized "runaway spend" in data analytics and found $168,000 in savings on AWS Config bills. They also saved their finance team five hours per month on reporting tasks.

"Considering cost upfront makes your innovations much more durable." – Chris Gray, Principal Engineer, Upstart

Meanwhile, Adaptavist took a strategic approach in October 2025, saving $800,000 by switching to Spot instances for CI/CD pipelines, which cut $13,200 per month, and implementing Savings Plans that reduced costs by another $26,346 monthly – a 13% overall drop.

"Making cost optimisation everyone’s responsibility, not just the platform team’s problem to solve." – Dan Chalk, Engineering Manager, Adaptavist

These examples show that focusing on internal savings and operational efficiency can create a strong foundation for growth. But there’s another key strategy to consider: exploring alternative infrastructure options.

Consider Bare Metal Options Like TechVZero

Beyond negotiating better terms, evaluating alternative infrastructure options can significantly improve cost efficiency. The mere possibility of moving workloads can shift the conversation with vendors, often leading to better deals.

Take TechVZero, for example. This bare metal infrastructure option provides a compelling alternative to managed cloud services, cutting Kubernetes costs by 40–60% without compromising reliability. In one case, TechVZero saved a client $333,000 in a single month while successfully managing a DDoS attack. Their model? They charge 25% of the savings for one year – nothing if they don’t meet their cost targets. Operating at a scale of 99,000+ nodes, they’ve proven their reliability.

For SaaS and AI startups, this creates immediate leverage. When AWS or Google Cloud knows you’re seriously considering a bare metal migration for Kubernetes workloads, they often adjust their pricing. You don’t even have to follow through with the migration – just having the option on the table can change the dynamics. And if you do switch? You get the same reliability at a fraction of the cost, saving up to 60%.

Conclusion: Get Better Vendor Terms Without Legal Teams

You don’t need a legal team to secure better vendor terms – what you need is preparation, solid data, and smart timing. Startups achieving 20–30% discounts below market rates don’t get there by luck. They rely on detailed usage audits, pricing benchmarks, and a firm grasp of their leverage.

Before you even approach a vendor, take a close look at your current usage. Identify and eliminate unused licenses (like shelfware sitting idle for 90+ days), and project your needs for the next 3–5 years. Doing this groundwork not only prevents overcommitting but also gives you the confidence to push back against inflated pricing.

Metrics are your strongest tool in negotiations. Keep track of critical performance indicators such as uptime, response times, seat utilization, and renewal schedules. With 88% of small and mid-sized SaaS companies now shifting contract management responsibilities to finance and operations teams, having documented performance data can help you negotiate service credits, limit annual price hikes to 3–5%, and sidestep auto-renewal pitfalls.

Timing can make or break your deal. Aim to negotiate around a vendor’s fiscal year-end – like Salesforce’s on January 31 or AWS’s on December 31 – when sales reps are eager to close deals and meet quotas. Pairing this timing with competitive quotes from 2–3 alternative vendors can amplify your bargaining power. This combination of timing and leverage is the backbone of successful negotiations.

"You should always be willing to negotiate with the vendor if you want to impact your bottom line positively." – Jinendra Jain, Global Head of Finance, Tiger Analytics

FAQs

What’s the best way for startups to review their SaaS usage and cut costs?

Startups looking to trim expenses can benefit from auditing their SaaS usage regularly and putting structured cost management practices in place. A good starting point is to tag and label resources accurately, monitor how they’re being used, and review any cost changes on a weekly basis. This helps identify areas of waste, such as idle or oversized resources. Automating budgets and setting up alerts for unexpected spending spikes are also smart ways to keep costs in check.

For even greater savings, think about rightsizing resources – adjusting them to fit your actual needs – and scheduling usage during off-peak times. These steps alone can cut costs by 25–45%. SaaS management tools are another valuable resource; they help track usage, send reminders for upcoming renewals, and flag dormant licenses. This ensures you’re only paying for what you truly need. By combining these practices with ongoing efforts to optimize spending, startups can stay on top of their SaaS budgets and even negotiate better deals with vendors.

What are the best times to negotiate better terms with vendors?

When it comes to negotiating vendor terms, timing can make all the difference. Vendors often operate on sales cycles tied to their fiscal calendars, which means quarter-end and year-end periods can be prime opportunities to strike better deals. Why? These periods often come with increased sales pressure, pushing vendors to close deals quickly.

Take Oracle, for instance. Their fiscal year wraps up in late spring, making May a strategic time to negotiate. Similarly, if you’re dealing with Microsoft Azure, aligning your discussions with their sales and consumption forecasts can help you optimize commitments and secure better terms.

Another effective approach is to start negotiations early – ideally about six months before your contract renewal. This gives you enough time to audit your current usage, explore alternative solutions, and avoid the last-minute rush that often benefits the vendor more than you. By combining this proactive timeline with an understanding of fiscal sales cycles, you can increase your leverage and negotiate terms that work in your favor.

How can businesses negotiate more flexible and scalable vendor contracts?

When negotiating vendor contracts, it’s crucial to think ahead. Start by identifying your current needs and estimating how your business might grow in the future. This approach helps you avoid signing agreements that either lock you into unnecessary commitments or leave you short on resources.

To ensure your contract adjusts as your needs evolve, request terms that allow for changes – like scaling up or down – without penalties. This kind of flexibility can be a game-changer as your business grows.

Another way to strengthen your negotiation is by using market data and benchmarks. These can provide leverage to ask for favorable provisions, such as:

- Adjustment clauses to account for changing needs.

- Scalable pricing models that align with your growth.

- Clear Service Level Agreements (SLAs) that define performance expectations and flexibility options.

By focusing on these elements during negotiations, you can secure a contract that not only supports your business’s growth but also keeps costs manageable.